Investment Risk Management

Properly allocating assets and minimizing risk are some of the most important financial decisions that investors can make. That’s because your target portfolio should be created to ideally balance risk and reward according to factors like your overall financial goals, your risk tolerance, and your investment time horizon.

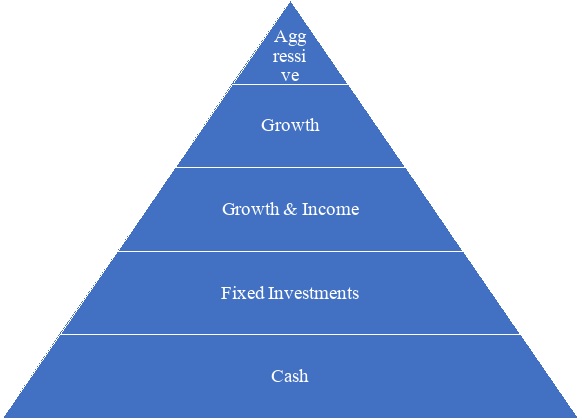

Asset allocation* is oftentimes viewed as a pyramid, with the base representing a good, solid foundation of cash and cash equivalents, and assets with the potential for higher returns – but that also represent more risk – moving up towards the top.

But even if you’ve created a well-diversified financial plan, this isn’t a one-time, set-it-and-forget-it endeavor, because your asset allocation mix will typically evolve over time as these criteria can, and often do, change throughout your lifetime.

For instance, as you move closer to retirement, you will likely opt to reduce risk, and hone in more on income-oriented financial vehicles. You may also want to focus on seeking to ensure that your portfolio can handle a potential market downturn.

One of the best ways to ensure proper asset allocation is to work with a financial professional who can take a look at the whole picture, as well as the short- and long-term financial goals you have in mind. That’s exactly what we do at Frank Financial Concepts.

Would you like a review of your portfolio to determine whether or not your assets are best positioned for you? If so, set up a no obligation meeting with us.

*Asset allocation does not assure or guarantee better performance and cannot eliminate the risk of investment losses.Diversification cannot eliminate the risk of investment losses.